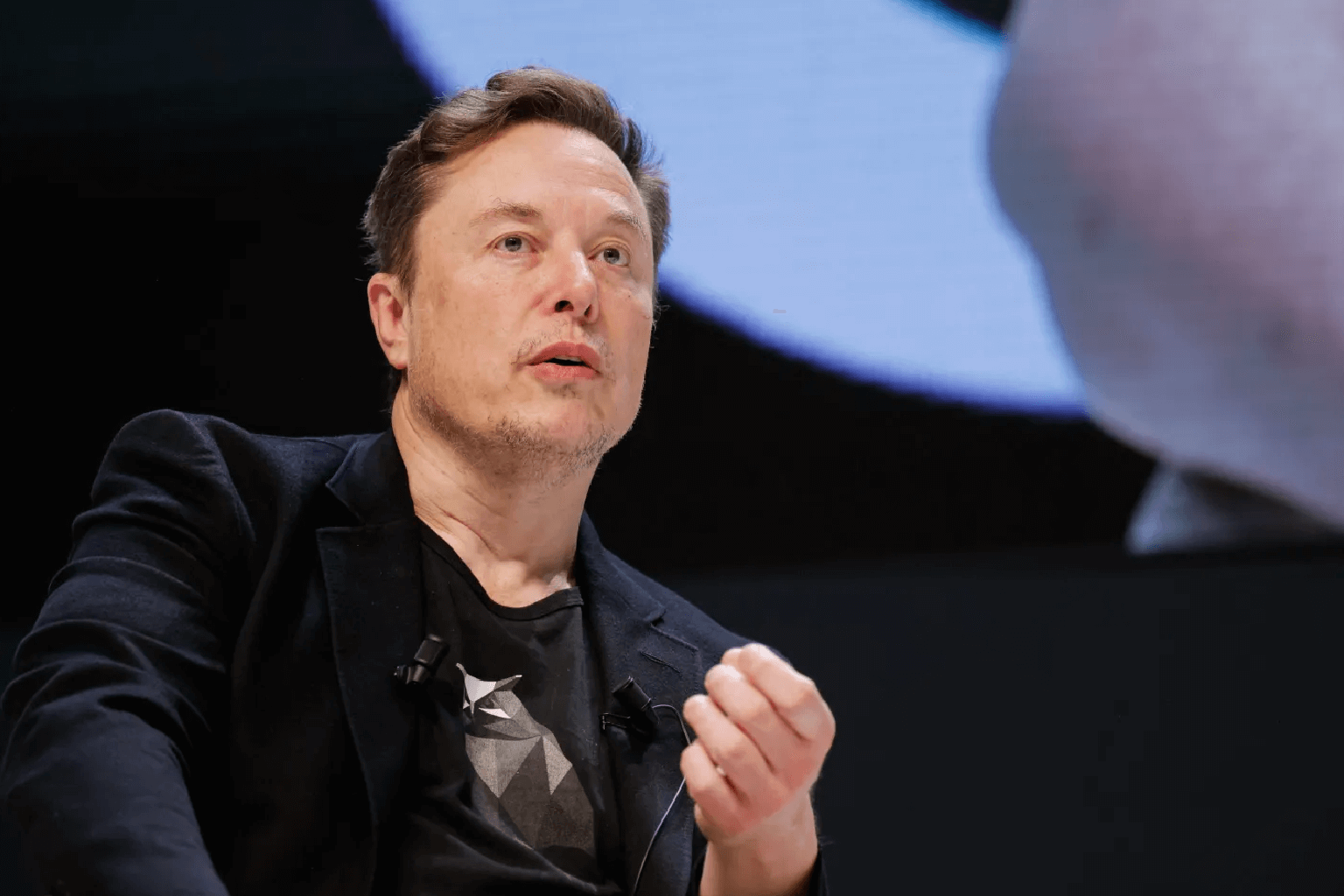

Elon Musk’s AI Gig Why It Should Remain Independent from Tesla

Elon Musk’s emphasis on integrating Tesla’s AI and robotics ambitions, including potential collaborations with his AI venture xAI, raises concerns about conflicts of interest and whether these ventures will take away from Tesla’s core electric vehicle business.

One of the more positive analysts on Tesla Inc. summed up their view in a line from a report this summer: “The car is to Tesla what the video game chip is to Nvidia.” “The car is what selling books is to Amazon,” Elon Musk said. Adam Jonas of Morgan Stanley was arguing that Tesla is changing from a company that makes electric cars to a giant in artificial intelligence and robotics. 1.

Accordingly, a Tesla isn’t just a box with wheels and a battery; it’s also an AI-delivery vehicle. Elon Musk, Tesla’s CEO, also supports this idea. He said, “If someone doesn’t believe Tesla is going to solve autonomy, I think they should not be an investor in the company.”

That sentence might need an asterisk next to it. The WSJ reported this weekend that Musk’s artificial intelligence side project, xAI, has talked about the idea of licensing its models to help Tesla’s self-driving car goals in exchange for a revenue-sharing deal. Musk laughed off the story in a series of tweets, one of which called it “nonsense.”

On the other hand, Musk called Reuters “lying” when it said that Tesla had scrapped plans for an electric vehicle that cost less than $30,000. Soon after, the company announced that it would be shifting its focus from making cheap electric vehicles to making robotaxis.

Additionally, Musk, known for his fair and unbiased followers, asked them if they believed Tesla should invest $5 billion in xAI. Most of them said yes. Listen closely; you hear the wind blowing through a bunch of bright red flags.

Musk often talks about his different businesses as if they were one big company. The worst example was when Tesla bought SolarCity Corp. in 2016. The EV company acquired a failing rooftop solar business under the leadership of Musk’s cousin.

Musk was the board’s chairman and owed Tesla and Space X money. Later, even Jonas called that deal “controlled detonation.” Musk brought in Tesla engineers to look over Twitter Inc.’s code when he first bought the company, which later became X. A few months ago, Musk sent thousands of Nvidia Corp. chips intended for Tesla to xAI instead, citing a process error.

Potential Conflict of Interest

The possible conflict of interest would be very clear if Tesla invested billions of dollars in xAI and/or split profits with it. Since Musk took over, X has had a challenging time as a business.

Advertising revenue has been low, and one of the investors, Fidelity, has marked down the value of its stake significantly. It’s unclear if X or its shareholders would own 25% of xAI, but Musk said they would. In either case, any money or potential for making money from Tesla would help xAI and the X project as a whole.

It would also be silly for Tesla to say why it gave Musk such a huge package of options and then pushed for its reinstatement after a Delaware court threw it out.

Robyn Denholm, Chairwoman of the Board, urged shareholders to vote yes, saying that it would keep Musk’s attention on Tesla: “We want those ideas, that energy, and that time to be at Tesla, for the benefit of you, our owners,” she wrote. This came after Musk made a clear threat to take his AI vision elsewhere if he didn’t get a bigger stake in Tesla (he had already sold some during the Twitter takeover).

Musk runs a company whose name includes the word “AI.” If Tesla ends up investing in or signing a contract with that company, it suggests that at least some of Musk’s AI ideas went somewhere else, option or not. There’s a bigger problem here than just government disagreements and trolling.

Like other optimistic analysts, Jonas only gives the making and selling of electric vehicles (EVs) a small part of Tesla’s value, even though they bring in and make the company a lot of money. Only the idea that Tesla is more than just an automaker and is a leader in AI can explain its market value of almost $700 billion.

But if that’s the case, and if Tesla is going to “solve autonomy,” then why would it think about outsourcing core AI tasks or putting billions of dollars into a first-year startup? When it comes to some technologies, automakers do work with other businesses.

On the other hand, Musk has said for years that Tesla is almost ready to make self-driving cars a reality. Investing money or revenue in xAI would undermine this narrative, diverting some of the promised value from Tesla’s shareholders to Musk’s other businesses.

Perhaps these ideas and polls remain unchanged. Still, there was one part of Jonas’s report that stuck out: it told investors to get ready for the company’s new plan to “more conspicuously connect Tesla with Elon’s other controlled enterprises such as SpaceX/Starlink, X, and xAI.” Let yourself do what you want when you’re autonomous.